Banking on Happiness?

A new cloud-first financial institution, ORO Bank, has launched to serve Individuals and businesses in Bhutan, and around the world, with a specific focus on safe, innovative and sustainable banking

100% of your cash deposits will be kept safe and available for immediate withdrawal.

Sign up and get started today.

Get started

Being a small nation makes us a smart nation, this is not out of choice but out of necessity. Technology is an indispensable tool that will be necessary to realize this aspiration

Jigme Khesar Namgyel Wangchuck

At the moment, ORO Bank registration is not available for Bhutanese citizens residing in Bhutan. We recommend exploring Digital Kidu, a Bhutanese bank where you can easily open an account. We appreciate your understanding.

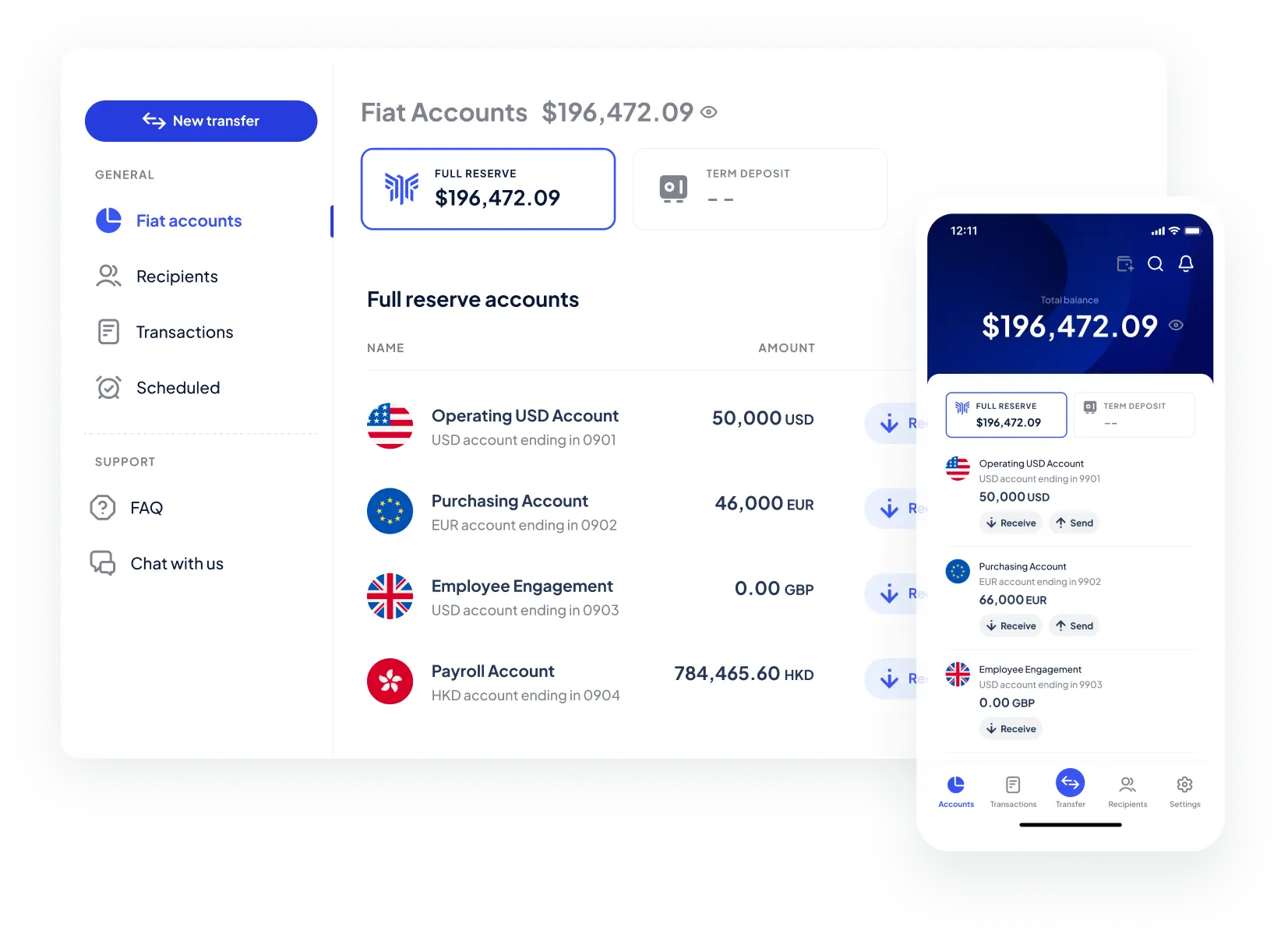

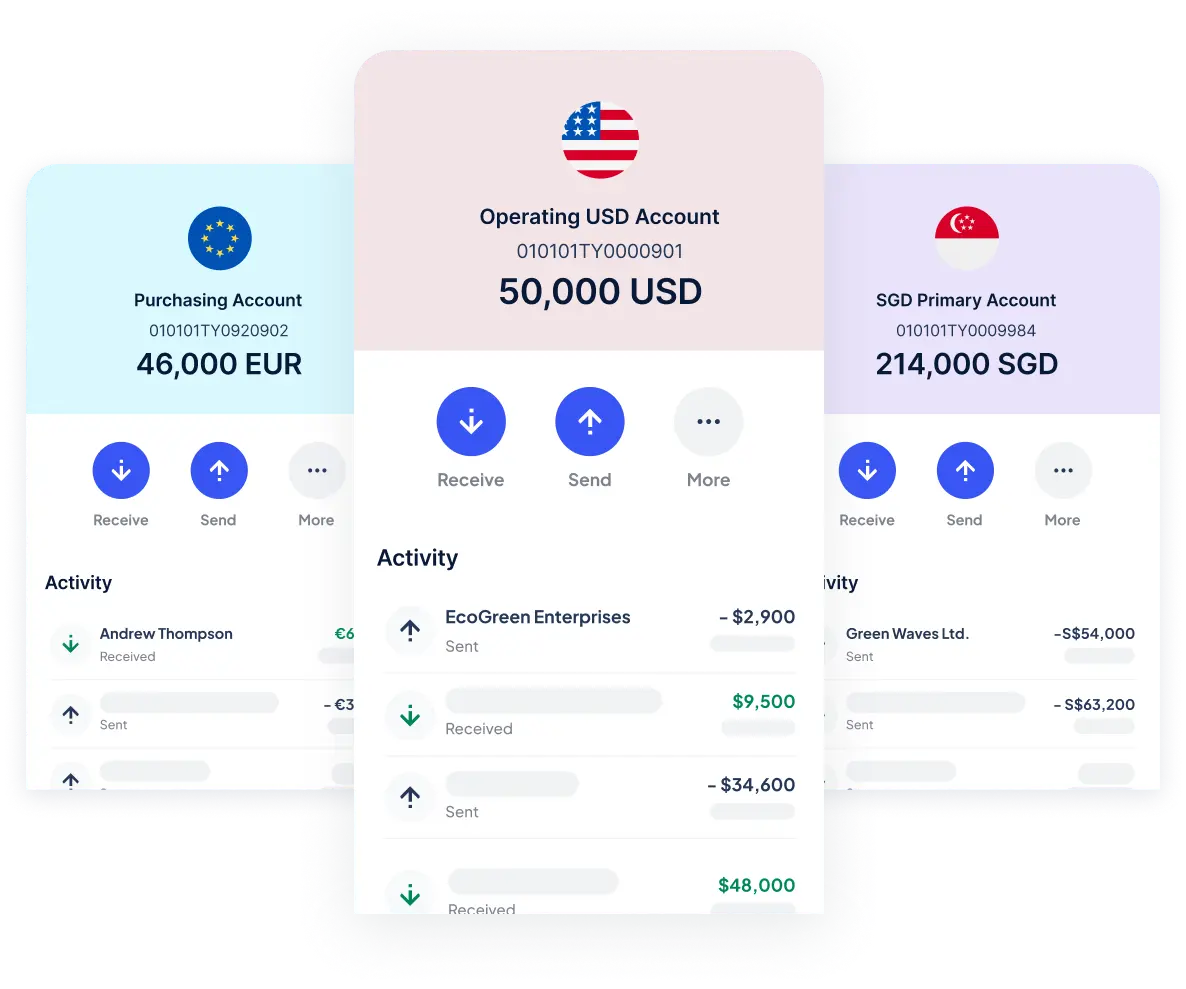

7 currencies supported

USD, EUR, GBP, SGD, HKD, JPY, and AUD

More currencies are coming 🚀

*Approval time may vary*

Screen customers against 1000+ global watchlists and 100+ sanctions lists, incl. OFAC, UN, HMT, EU, DFAT, etc

Identify PEPs by checking 7,000+ sources and providing their profiles, including information on family members and close associates

Monitor thousands of media sources for negative mentions and aggregate the data into customer profiles on an ongoing basis

Harness the power of AI and industry expertise to detect AML/CFT risk and stay compliant with our cutting-edge transaction monitoring solution.

No account opening or maintenance fees. No minimum balance. No overdraft or returned wires fee. However, we may charge small fees for future investment products or value-added services (3rd party fee may apply).

Instant O-Net transactions and rapid international transfers, all with efficient settlements, ensuring your funds ready at all time.

Your deposits are always 100% available and never used for lending or investments. This is core to our business proposition, values, and our unwavering commitment to customers and the standard by which we are regulated.

Our compliance with global guidelines ensures that your money is always handled responsibly and securely, no matter where in the world it goes.

Create and transfer between different currency accounts without the hassle of conversion.

A new cloud-first financial institution, ORO Bank, has launched to serve Individuals and businesses in Bhutan, and around the world, with a specific focus on safe, innovative and sustainable banking

ORO Bank, touted as Asia’s first full-reserve digital bank, leveraged global financial software provider Finastra’s SaaS core banking solution to launch its cloud-based platform within six months. The Bhutanese bank had launched last week.

ORO Bank aligns with Bhutan’s national values and is targeting global tech start-ups, CEO says. ORO Bank launched its minimum viable product (MVP) on May 24 as the official bank of Bhutan’s Gelephu Mindfulness City.

Full reserve banking means 100% of a customer's current account deposits (also

called ‘demand - deposits,’ i.e., not including ‘time / term - deposits’) is

fully backed by corresponding reserves, thereby mitigating the risks

associated with bank runs and providing unparalleled financial stability. The

customer’s money will always be available when needed.

Traditional banks, on the other hand, engage in 'fractional reserve banking',

lending out customer deposits, which introduces risk and potential limitations

on withdrawals, as we observed with the bank run at Silicon Valley Bank, where

$142 billion out of $175 billion in customer deposits were withdrawn (or

queued to be withdrawn) within two days, leading to its collapse.

Since we keep 100% of your full reserve account deposits and do not invest or lend any portion, your money is always secure, safe, and available when you need it. The downside is that your full reserve account does not earn interest. ORO Bank offers other products such as time / term deposits, allowing you to control how much of your funds are invested in interest bearing products (coming soon).

ORO Bank welcomes everyone. Our inclusive approach extends to all individuals and entities, including those typically not served by traditional banks, such as startups, fintech companies, and other businesses. If you fit the following, ORO Bank is for you!!

At present, ORO Bank supports transfers in 7 currencies: USD 🇺🇸, EUR 🇪🇺, GBP 🇬🇧, SGD 🇸🇬, HKD 🇭🇰, JPY 🇯🇵, and AUD 🇦🇺.

Enjoy ORO Bank’s services without any fees. There are no account opening fees, no maintenance

fees, and no overdraft fees.

However, when we launch investment products and value added services in the future, we will

charge a small transaction fee.

*Please note that third-party fees, such as SWIFT transfer fees, may apply.

Bhutan, nestled in the Himalayas, is a serene kingdom renowned for its breathtaking landscapes, vibrant cultural heritage, and commitment to Gross National Happiness. Bhutan’s vision and leadership assure political independence and stability, with a strong focus on sustainability and wellness that aligns perfectly with ORO Bank’s mission. The creation of a Special Administrative Region demonstrates Bhutan’s commitment to innovation, making it an ideal location for ORO Bank and its customers.

ORO is the national bird of Bhutan and symbolizes divine guidance and protection for the country. Additionally, ORO means gold in Spanish. This dual symbolism emphasizes our commitment to intelligence, guardianship, and the enduring value we strive to provide our customers.

Experience the power of sustainable, full reserve banking